In other states, the program is sponsored by Community Federal Savings Bank, to which we’re a service provider. The British Pound vs. the New Zealand Dollar cross is one of the most volatile one among GBP pairs. The New Zealand Dollar is often viewed as a proxy for Chinese growth and thus have performed well against the Euro in recent years.

Beware of bad exchange rates.Banks and traditional providers often have extra costs, which they pass to you by marking up the exchange rate. Our smart tech means we’re more efficient – which means you get a great rate. Nothing contained in or on the Site should be construed as a solicitation of an offer to buy or offer, or recommendation, to acquire or dispose of any security, commodity, investment or to engage in any other transaction. SSGA Intermediary Business offers a number of products and services designed specifically for various categories of investors.

The products and services to which this communication relates are only available to such persons and persons of any other description (including retail clients) should not rely on this communication. Currency Risk is a form of risk that arises from the change in price of one currency against another. Whenever investors or companies have assets or business operations across national borders, they face currency risk if their positions are not hedged. We are negative on the franc over both the tactical and strategic horizons. It is the most expensive G10 currency per our estimates of long-run fair value.

Related Currencies

They add hidden markups to their exchange rates – charging you more without your knowledge. It is cheap vs. the US dollar, the British pound, the euro, and the Swiss franc, and has room to appreciate, but is expensive against the yen and the Scandinavian currencies. In August, we shifted from neutral to modestly negative on the krona on a weaker economic outlook and poor local equity market performance. The Riksbank is likely to keep pace with or tighten more than the ECB over the next several months given the stickiness of core inflation. That sounds positive on the surface, but will put further pressure on the economy and weigh on the krona’s outlook.

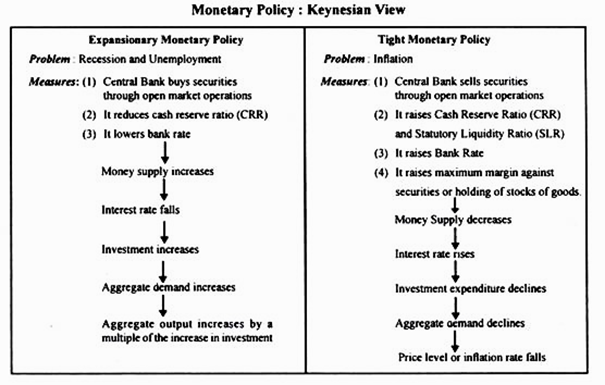

This divergence highlights the potential for sector-specific trading strategies, as different industries can react differently to the same macroeconomic indicators. In Japan, bank shares experienced noticeable gains with the prospect of higher interest rates. The Nikkei 500 banking index rose by over 3%, while the broader Nikkei 225 index fell by approximately 0.5%. Prior to today’s ECB meeting, there was a bit of uncertainty whether the ECB would hike or not, with markets pricing in a 65% implied probability of a 25-bps hike.

Xe International Money Transfer

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block. Live tracking and notifications + flexible delivery and payment options. All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Our long-run valuation model suggests that the pound is cheap. However, low productivity growth and high inflation are pushing fair value lower, which is on pace to trend down to the lower 1.30s against the US dollar over the next few years.

But on the hand, the British Pound is one of the premier reserve currencies and represents the world’s largest financial center. China’s credit data exceeded expectations, leading to a dip in the USD/CNH (US Dollar/Chinese Yuan) after the fix. New Yuan loans were CNY 1.36 billion in August, above forecasts of CNY 1.25 billion.

Major Currencies

Nothing on this web site shall be considered a solicitation to buy or an offer to sell a security to any person in any jurisdiction where such offer, solicitation, purchase or sale would be unlawful under the securities laws of such jurisdiction. This document may contain certain statements deemed to be forward-looking statements. All statements, other than historical facts, contained within this document that address activities, events or developments that SSGA expects, believes or anticipates will or may occur in the future are forward-looking statements.

Pound New Zealand Dollar Exchange Rate Weekly Forecast: GBP … – TorFX News

Pound New Zealand Dollar Exchange Rate Weekly Forecast: GBP ….

Posted: Tue, 15 Aug 2023 07:00:00 GMT [source]

USDCAD in an aggressive decline from its 5-month high of 1.3693Bears eye the crucial 200-day SMAMomentum indicators suggest more pain in the short termUSDCAD had staged a massive… Hong Kong’s morning trading session will be delayed due to the issuance of a Black Rainstorm Warning alert issued by the government. Tencent-backed Tuhu Car plans to raise up to 1.26 billion Hong Kong dollars ($160.89 million) through an initial public offering in Hong Kong. SoftBank Group shares rose Friday morning in Tokyo after chip designer Arm surged in its Nasdaq debut overnight, raising hopes for a recovery in the IPO market. The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

NZD to GBP – Convert New Zealand Dollars to British Pounds

The information provided on the Site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. We maintain our neutral to slightly negative view on the euro in response to the steady stream of weaker economic data surprises and rising stagflation risk. Any return of pessimism and equity volatility over the next few months would likely support the euro vs. higher-beta currencies as we saw in August, but a broad euro upside appears unlikely in the near future. Check live rates, send money securely, set rate alerts, receive notifications and more. You can send a variety of international currencies to multiple countries reliably, quickly, and safely, and at a rate cheaper than most banks. The products and services described on this web site are intended to be made available only to persons in the United States, and the information on this web site is only for such persons.

Our models are neutral on the Canadian dollar, with improved oil prices offsetting modest softening in economic data and sluggish relative Canadian equity market performance. Our view of the British pound is increasingly negative in response to the decelerating economic data, persistently high inflation, and poor UK equity market performance. We expect the Bank of England (BoE) to raise rates again at its September meeting and probably at least one more time by year-end . But that may provide little support for the pound as tighter monetary policy further damages an economy already teetering close to recession. In the near term, currency market performance is likely to look similar to that in August, with more cyclically sensitive currencies underperforming. The British pound looks increasingly vulnerable as economic data surprises turn negative, and, while we expect the Norwegian krone to have difficulty in the face of higher equity volatility, it looks increasingly oversold relative to strong oil prices.

- The high-growth, high-yield, safe-haven USD was the big winner in August, while the risk-sensitive NOK led the downside despite stronger oil prices.

- Perceived safe-haven assets are not guaranteed to maintain value at any time.

- Crude oil is mostly steady with the West Texas Intermediate (WTI) futures contract slipping slightly toward US$ 87 while the Brent contract is trading near Friday’s close just above US$ 90.50.

- The timing of these factors requires patience and tolerance for additional yen weakness.

- We confidently believe that the next big, sustained move in the dollar is lower – a broad decline of 10%–15% – but it appears early for that now.

We shift from neutral to slightly positive on the krone as it appears oversold relative to the recent strength in oil prices, late August recovery in equity markets, and hopes of further monetary tightening. Banks often advertise free or low-cost transfers, but add a hidden markup to the exchange rate. Wise gives you the real, mid-market, exchange rate, so you can make huge savings on your international money transfers.

Past performance is not a reliable indicator of future performance. Investing involves risk including the risk of loss of principal. All material has been obtained from sources believed to be reliable. This news could be a positive signal for traders, as a healthier credit environment in China can potentially lead to increased economic activity and investment opportunities.

New Zealand Dollar to British Pound stats

We give you the real rate, independently provided by Reuters. Compare our rate and fee with Western Union, ICICI Bank, WorldRemit and more, and see the difference for yourself. Create a chart for any currency pair in the world to see their currency history. These currency charts use live mid-market rates, are easy to use, and are very reliable.

- The Site is not directed to any person in any jurisdiction where the publication or availability of the Site is prohibited, by reason of that person’s nationality, residence or otherwise.

- Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes.

- But that may provide little support for the pound as tighter monetary policy further damages an economy already teetering close to recession.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion. All investment services are provided by the respective Wise Assets entity in your location. All persons and entities accessing the Site do so on their own initiative and are responsible for compliance with applicable local laws and regulations. The Site is not directed to any person in any jurisdiction where the publication or availability of the Site is prohibited, by reason of that person’s nationality, residence or otherwise. Eventually, likely in 2024, Swedish and global inflation will be under control and the economy will begin a more durable recovery. Once that happens, the historically cheap krona has substantial room to appreciate back toward its long-run fair value on a sustained basis.

GBP into NZD Average Daily Volumes Traded:

It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. We are pessimistic on the New Zealand dollar over the near term. Rising recession risk and the weak external balance – the current account is –8.1% of gross domestic product (GDP) – more than offset any benefit of high yields, particularly now that the Reserve fob destination meaning Bank of New Zealand has likely ended its tightening cycle. In the longer term, we think Canadian growth will remain competitive and the Canadian dollar looks cheap in our estimates of fair value relative to the euro, the Swiss franc, and the US dollar, creating room for further upside. In commodities markets, iron ore futures traded higher on the Dalian and Singaporean exchanges.

Daily FX 13.09.23: US Inflation Data Key To Pound Vs Euro, Dollar – Exchange Rates UK

Daily FX 13.09.23: US Inflation Data Key To Pound Vs Euro, Dollar.

Posted: Wed, 13 Sep 2023 12:35:00 GMT [source]

Our currency rankings show that the most popular New Zealand Dollar exchange rate is the NZD to USD rate. These percentages show how much the exchange rate has fluctuated over the last 30 and 90-day periods. These are the lowest points the exchange rate has been at in the last 30 and 90-day periods. These are the highest points the exchange rate has been at in the last 30 and 90-day periods.

The pound is still cheap at those levels, but UK’s cyclical weakness and falling long-run pound fair value make for a tough outlook for the BoE and the currency into 2024. Crude oil is mostly steady with the West Texas Intermediate (WTI) futures contract slipping slightly toward US$ 87 while the Brent contract is trading near Friday’s close just above US$ 90.50. The yen has seen a small bounce after BOJ Governor Ueda hinted at a “quiet exit” from negative interest rates but expectations for anything substantial remain… Data are provided ‘as is’ for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements.

Assets may be considered “safe havens” based on investor perception that an asset’s value will hold steady or climb even as the value of other investments drops during times of economic stress. Perceived safe-haven assets are not https://1investing.in/ guaranteed to maintain value at any time. The information provided does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security.